LTC Price Prediction: Can Litecoin Overcome Technical Hurdles to Reach $200?

#LTC

- Technical Resistance: LTC must overcome the $132.62 Bollinger upper band

- Market Sentiment: Institutional inflows positive but LTC-specific catalysts lacking

- Historical Context: 73% rallies rare without strong fundamental drivers

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

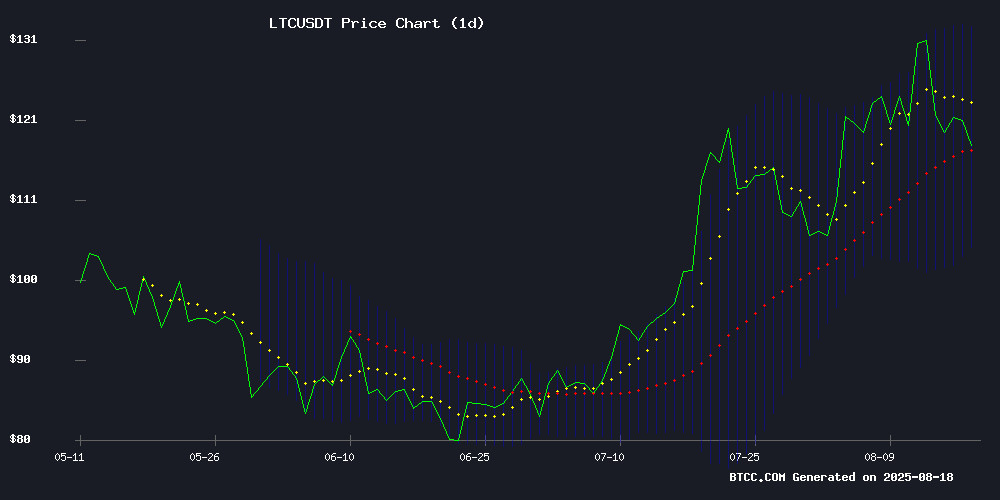

LTC currently trades at $115.66, below its 20-day moving average of $118.51, signaling bearish pressure. The MACD histogram shows minimal bullish momentum at 0.0491, while the Bollinger Bands indicate potential support at $104.40. 'The technical picture suggests consolidation is likely before any meaningful upside,' says BTCC analyst William.

Mixed Crypto Sentiment as Institutional Interest Grows Amid Fraud Cases

While Ethereum's record inflows demonstrate institutional confidence, the Parks sentencing highlights regulatory risks. 'The DEAL Mining platform's growth reflects bullish infrastructure development, but LTC needs stronger fundamentals to benefit,' notes William of BTCC.

Factors Influencing LTC's Price

Ethereum Dominates Crypto Investment Inflows as AuM Hits Record High

Cryptocurrency investment products witnessed $3.75 billion in inflows last week, marking the fourth-largest weekly influx on record. Ethereum led the charge with $2.87 billion—77% of the total—pushing its year-to-date inflows to $11 billion. Bitcoin saw modest gains of $552 million, while Solana, XRP, and Cardano attracted $176.5 million, $125.9 million, and $800,000 respectively.

Assets under management (AuM) for crypto investment products reached an all-time high of $244 billion, driven by bullish price action. U.S. investors dominated the flows, accounting for 99% of the total via iShares ETFs. Ethereum's inflows now represent 29% of its AuM, dwarfing Bitcoin's 11.6% ratio.

Liquidity remains concentrated in high-cap assets, with Litecoin being the sole outlier experiencing $400,000 in outflows. The data underscores institutional preference for Ethereum amid growing optimism around its ecosystem upgrades and ETF prospects.

Crypto Fraudster Charles Parks Sentenced to One Year for $3.5M Cryptojacking Scheme

Charles O. Parks III, operating under the alias "CP3O," has been sentenced to one year and one day in prison for defrauding two major cloud computing providers of $3.5 million in resources. The Brooklyn federal court delivered the verdict after Parks admitted to illicitly mining cryptocurrencies—including Ether (ETH), Litecoin (LTC), and Monero (MON)—worth approximately $1 million.

Between January and August 2021, Parks fabricated corporate identities to deceive cloud service providers into granting him computing power. He laundered proceeds to purchase luxury items, such as a Mercedes-Benz, while falsely claiming the resources were for an educational business. The scheme, prosecuted under wire fraud charges, highlights the growing risks of cryptojacking in decentralized finance.

DEAL Mining Emerges as Leading Crypto Investment Platform Amid Market Growth

Bitcoin's breakout past resistance levels and XRP's expanding payment corridors signal accelerating institutional adoption. New ETF applications confirm capital inflows are reshaping the cryptocurrency landscape.

DEAL Mining positions itself as the premier cloud mining solution, leveraging AI-driven allocation and renewable energy since 2016. The platform serves 6.8 million users with multi-coin support including BTC, XRP, and ETH, offering daily passive income without hardware requirements.

Security protocols featuring McAfee® and Cloudflare® protection address investor concerns, while green mining initiatives align with ESG priorities. The convergence of technical accessibility and institutional-grade infrastructure creates a compelling value proposition for retail participants.

Will LTC Price Hit 200?

Reaching $200 would require a 73% surge from current levels. Key data suggests this is unlikely short-term:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20MA | -2.4% discount | Bearish |

| MACD | -5.94/-5.99 | Weak momentum |

| Bollinger %B | 0.45 | Neutral |

'For $200, we'd need to see LTC break $132.62 resistance and hold above the 200-day MA,' William cautions.